Q2 Earnings: Tremor Video & Marin Software

by Rebecca Muir on 5th Aug 2016 in News

Yesterday (4 August) Tremor Video, Inc. (NYSE:TRMR) announced strong financial results for the quarter ended 30 June, 2016. The company achieved 22% growth year-on-year, the majority of growth coming from programmatic.

Highlights

- Revenue of USD$37.1m (£28.25m), down 12% year-on-year

- Total Spend of USD$54.7m (£41.65m), up 19% year-on-year

- Gross profit of USD$17.2m (£13.10m), down 4% year-on-year

- Net loss of USD$5.9m (£3.81m); net loss per share of USD$0.11 (£0.08)

"This quarter we achieved a number of our strategic goals, including signing several key agency partnerships on our buyer platform", said Bill Day, Tremor Video CEO. "Based on the continued strength of our seller platform and Higher-Function buying products, we are projecting strong guidance for spend growth and EBITDA profitability in the second half of 2016."

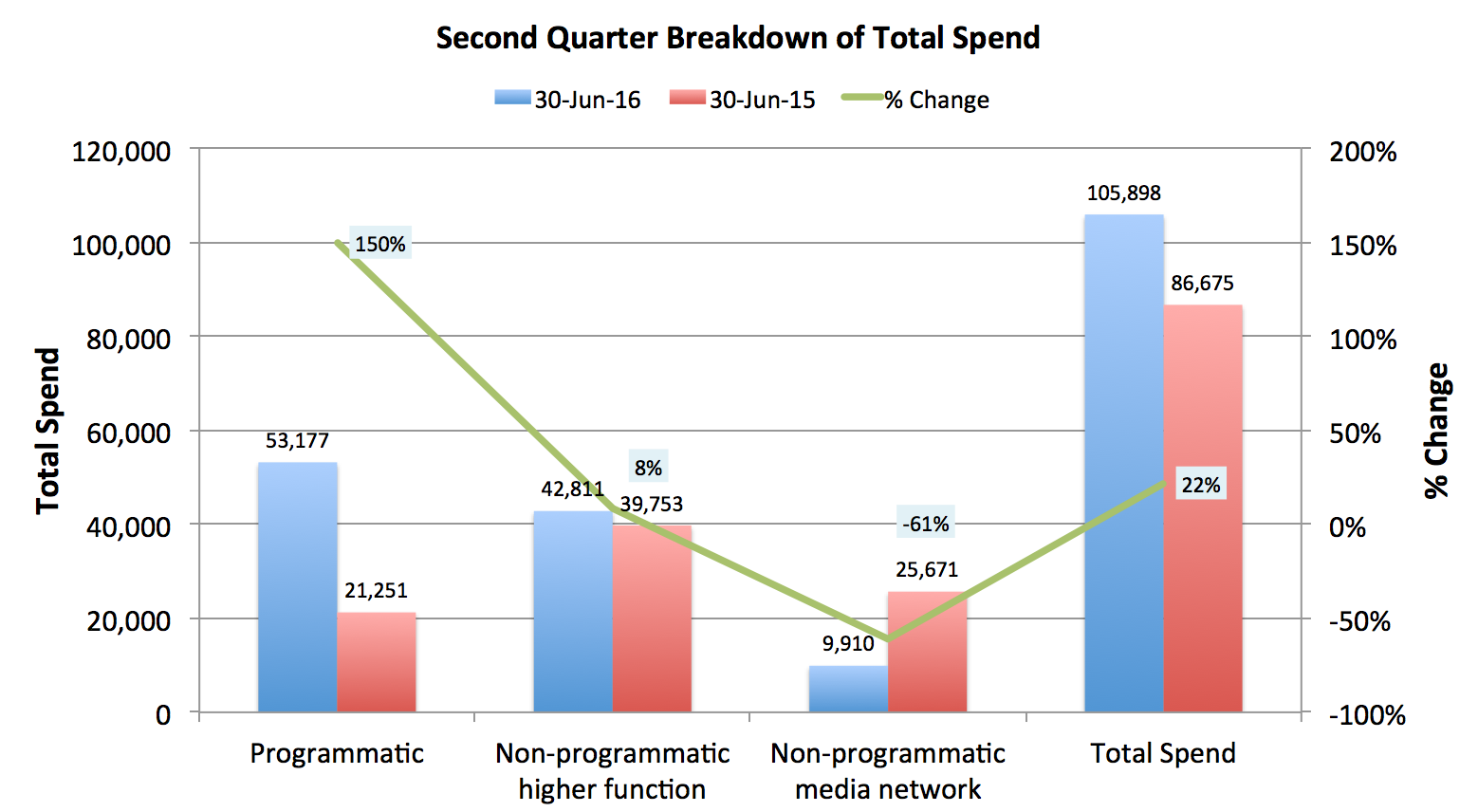

Source: Tremor Video

Programmatic spend has increased 150% year-on-year against overall year-on-year growth of 22%, reflecting the industry's growing love of the efficiency of programmatic and the performance gains it brings to campaigns.

Tremor video do not break out spend into mobile and desktop. Given the rapid rise in the popularity of video amongst consumers, and the inevitable advertisers' race to follow the eyeballs, it is highly likely that over half the growth in programmatic came through mobile.

Yesterday, Marin Software Incorporated (NYSE: MRIN), also reported earnings for the quarter ended 30 June, 2016.

"We have made solid progress in optimising the efficiency of our business over the past year, as demonstrated by the significant improvement in our operating margins and our third consecutive quarter of generating positive Adjusted EBITDA", said David A. Yovanno, chief executive officer of Marin Software. "We're encouraged by the progress we have made in unifying our search, social, and display advertising suite. Once complete, we expect to be in an attractive position to further extend our market-leading position."

Highlights

- Net revenues totalled USD$25.8 (£19.64), a year-on-year decrease of 4%

- GAAP gross profit was USD$16.9m (£12.87), resulting in a gross margin of 65%, a slight increase compared to the previous year

Product Releases

In the increasingly competitive cross-channel campaign management software sector, companies have to continually release new features that support publisher changes and provide users with the most efficient optimisation process. With many campaign managers fluent in two or more similar technologies, this is both a race and a battle.

Marin Software have been criticised in the past for not facilitating workflows that are as efficient as some of their competitors. Furthermore, they received criticism for a lack of development over the last 12 months. That said, things appear to be looking up, with the company making several key releases this quarter.

– Released full reporting and management capabilities for Google's recently updated ad format Expanded Text Ads, which is helping drive improved click-through and conversion rates for advertisers

- Introduced several product enhancements to its Shopping offering, including product feed distribution, SKU-level reporting, and enhanced bidding capabilities. Also released Smart Sync for Shopping, currently in alpha, which allows retailers to automatically build Facebook Dynamic Ads from their existing Google Shopping campaigns

- Released support for Facebook's Lead Ad format, with mass editing capabilities, and the ability to run reports within the app and through an application programming interface

- Introduced Dynamic Ads Prospecting, currently in beta, which enables advertisers running Facebook Dynamic Ads campaigns on Marin Social to have the ability to target prospects as well as re-market to existing customers who have visited their website or app

Cross-ChannelDisplayEarningsFacebookSearchVideo

Follow ExchangeWire