The New Agency Programmatic Strategy Revealed... in Two Handy Visuals

by Ciaran O'Kane on 19th Feb 2015 in News

The Echo Chamber is a regular column, penned by Ciaran O'Kane, on all things ad tech, mar tech and programmatic

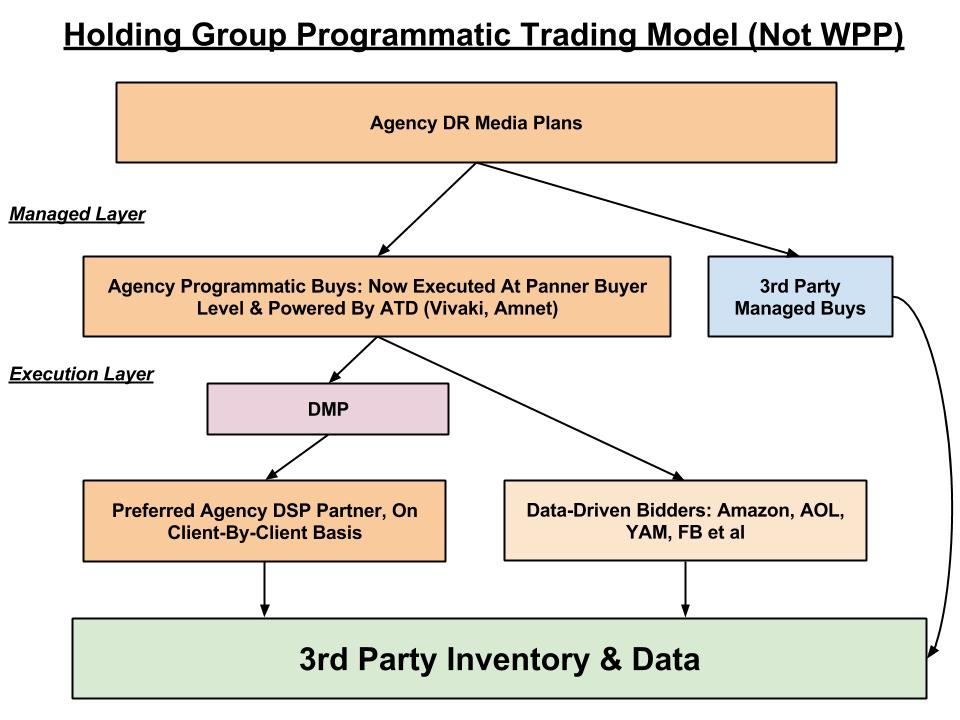

As reported by ExchangeWire this week, Publicis is re-organising some of its programmatic trading functions within the group with internal agencies now spearheading programmatic buying. Vivaki's role is now more consultative, working in tandem with the media planning function within the likes of Starcom and Zenith. The purpose is clear: to keep programmatic within the agencies, and curtail the outsourcing of the function to third parties.

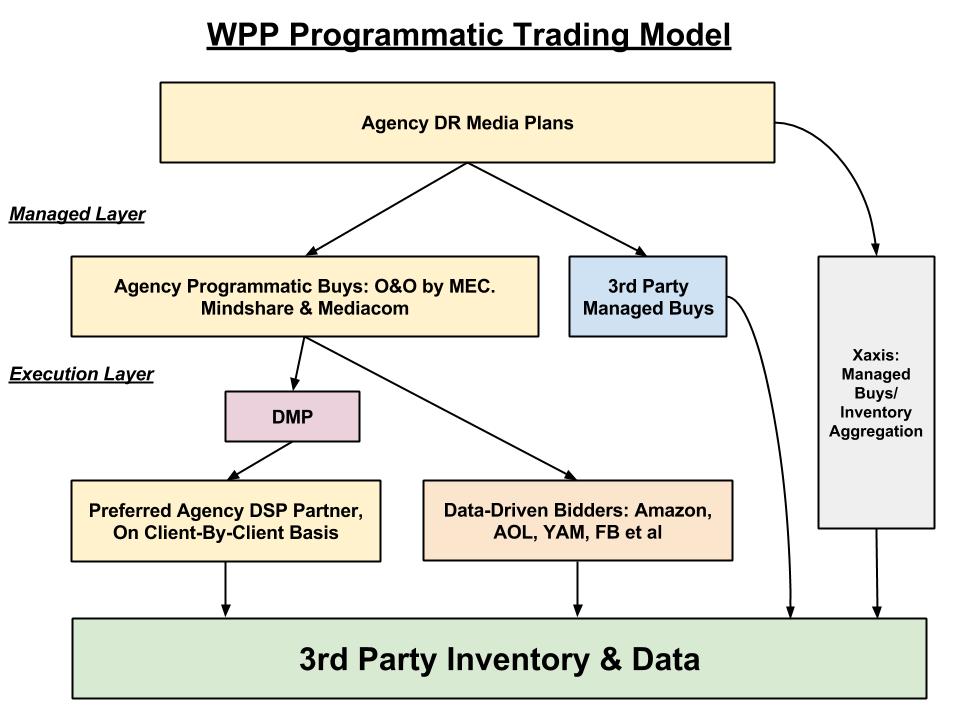

It all seems very convoluted, so in this week's Echo Chamber we have broken down the new agency programmatic trading models into two handy visuals: first, the WPP model, which is looking to incorporate internal optimisation offerings, like Xaxis, in different ways, as per client requests; and second, how the rest of the holding groups will likely build out their proposition for 2015.

Clarifying Some of the Workflow

Agency Programmatic Buys: Many of the internal agencies are setting up their own trading desks, mostly at the request of clients for programmatic to be baked into the media planning function. Vivaki, Amnet and other trading desks will now help the likes of Zenith, Carat et al to execute large chunks of programmatic spend. The ATD model now looks less like an ad network and more akin to a super Japanese agency consultative and data layer, DAC.

Third-Party Managed Buys: Outsourced ad net buys, effectively. This outsourcing will come under severe pressure from the new programmatic-enabled media planner buyers. Hence the pivot by the likes of Rocket Fuel to some sort of SAAS/media buying hybrid model.

DMP: This requires a visual of its own, and we did one already in a previous Echo Chamber post. The internal agencies might actually build their own, but in most cases will likely licence. Or in some outlier instances, particularly with huge FMCG brands, agencies will use their clients' licenced DMPs. There aren't likely to be any integrations with closed ecosystems -- so it's still a messy and incomplete process.

Data-Driven Bidders: The closed ecosystems - Facebook, Amazon, Yahoo, AOL, et al

Xaxis: Xaxis isn't going anywhere any time soon, and its dual positioning as both outsourced managed buying and aggregated inventory/data source will ensure that it remains a big profit centre for WPP.

Third-Party Inventory & Data: The greater media landscape of inventory and data supply.

There is no doubt that there will be some iterations of both models on a client-by-client basis. But it would appear the agencies are sensibly evolving the offerings - and gravitating away from pure play media arbitrage to a value-add based solution for brands.

AdvertiserAgencyDisplayTradingTrading Desk

Follow ExchangeWire