APAC Tops Global Mobile Adblockers; Japan Publisher Co-Op Kicks Off With Three

In this weekly segment, ExchangeWire sums up key industry updates on ad tech from around the Asia-Pacific region – and in this edition: APAC tops global mobile adblockers; Japan publisher co-op kicks off with three; AU online ads climb 33.5% in Q1; Asia to fuel luxury ad spend; Sparc Media opens up in Melbourne; and IMG acquires AU digital agency.

APAC tops global mobile ad blockers

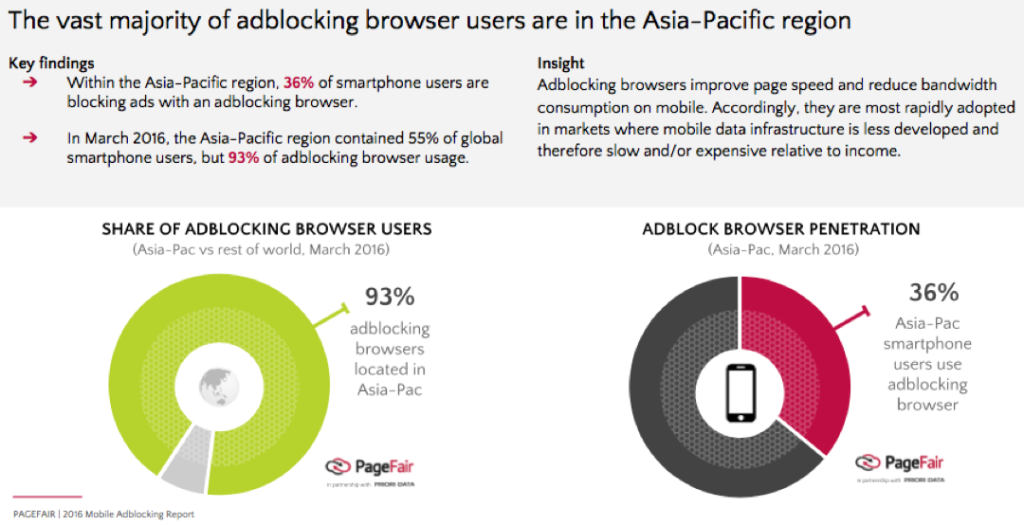

Asia-Pacific is the world's biggest user of mobile ad-blocking browsers, accounting for 93% of the world's use of such tools in March 2016.

According to a report released by PageFair, based on research conducted by Priori Data, the three top markets for ad blocking were China, India, and Indonesia, which together registered 319 million active ad-blocker browsers.

Ad-blocking browsers were the most popular tactic of mobile ad blocking, according to PageFair.

Globally, more than 419 million mobile users were blocking ads on browsers, representing 22% of the world's 1.9 billion smartphone users, revealed the report. Numbers excluded content-blocking apps, in-app ad blockers, as well as opt-in browser ad blockers.

In the Asia-Pacific region, 36% were using mobile ad-blocking browsers. Because ad-blocking browsers helped speed up page loading and reduce bandwidth consumption on mobile, PageFair noted that they would be most rapidly adopted in markets where mobile data networks were less developed and, hence, slow or expensive compared to the local average income.

It noted: "Many publishers and advertisers have hoped that mobile platforms and walled gardens would offer a refuge from ad blocking. As this report shows, this is not the case."

World Federation of Advertisers CEO Stephan Loerke said in the study: "We have heard the message loud and clear: an increasing number of people aren't satisfied with the online ad experience, and they're voting with their feet.

"The ad industry needs to better understand what is driving them to opt for ad blocking, and address the underlying issues head-on", Loerke added.

Japan publisher co-op kicks off with three

The country's first publisher co-operative has launched with three local players, offering a combined inventory that boasts more than 16 million unique users and 114 million pageviews monthly.

Called Delta Publisher Alliance, the co-op currently comprises Succor King, J-Cast News, and Auto Sport. The publishers' inventory across mobile and desktop will be available programmatically through Rubicon Project's ad platform.

Rubicon's Japan managing director Tomoyuki Ikeda said in a statement: "Co-operatives are a proven way for publishers to aggregate their inventory and compete effectively in the digital space.

"The launch of Delta Publisher Alliance is a huge step for this robust marketplace and will further fuel the growth of digital advertising spend in Japan, which is forecast to be worth USD$4.42bn (£3.13bn) in 2016, growing to over USD$6bn (£4.24bn) by 2020", Ikeda said, citing figures from eMarketer.

The Trade Desk's Japan country manager Tetsuya Shintani also noted that the establishment of the co-op was timely, as private marketplaces (PMPs) had been gaining momentum locally.

"We understand the value of audience data at scale across multiple premium publishers and have been delivering top-class PMP executions in the US and Europe", Shintani said. "We have long been working with Rubicon Project on this nascent area in Japan and the launch of Delta Publisher Alliance will bring great benefit for buyers."

He added that the co-op would further drive programmatic transactions "of high-quality premium inventory" in Japan.

According to Rubicon, the latest co-op was the 12th worldwide to be powered by the ad tech vendor.

AU online ads climb 33.5% in Q1

Australia's online advertising has clocked AUD$1.73bn (£918.06m) in the first quarter, ended March 2016, climbing 33.5% over the same quarter last year.

According to Interactive Advertising Bureau/PwC Online Advertising Expenditure Report, mobile ads accounted for almost 50% of general display, while video accounted for 25%. Numbers highlighted in the report were based on data sent to PwC by online ads selling companies.

The Australian digital ad market grew 25% year-on-year, from 2014 to 2015, outpacing the UK and US, which increased 16% and 20%, respectively. In fact, Australia's growth rates for video and mobile were significantly higher than the UK and US, according to PwC.

Fuelled by mobile and video, Australia's general display ads registered a 46.7% growth for the quarter, while search and directories ads grew 29.9%, and classifieds grew 20.8% year-on-year. Mobile ad spend for the quarter reached AUD$507.9m (£269.53m), with mobile display accounting for 57% and mobile search contributing 43%.

New Zealand's digital ad market climbed 31% year-on-year.

Asia to fuel luxury ad spend

Recovery in Asia and Eastern Europe is expected to push spend on luxury ads up by 3% this year, after a tough 2015 that saw a 1.9% increase.

Zenith's second annual Luxury Advertising Expenditure Forecasts also put overall spend on luxury ads at USD$10.9bn (£7.71bn) across the top 18 markets this year, up slightly from USD$10.6bn (£7.5bn) in 2015. The agency's top 18 markets include China, Germany, Singapore, South Korea, Taiwan, Spain, and the UK.

According to Zenith, the luxury ad market experienced a sluggish period between 2014 and 2015, when advertisers reacted to the slowdown in BRIC markets and local market conflicts and terrorism. Ad spend had dipped by 1.4% in Asia, and an even bigger 20.3% in Eastern Europe, although overall expenditure was lifted by 3.6% growth in North America and 4.7% increase in Western Europe.

Asia was projected to clock 2.9% growth this year, the report noted. It added that China, together with the US, would be the second-largest and largest luxury ad markets, respectively, between 2015 and 2017. During this period, the two economies would account for 82% of overall growth.

China, in 2015, contributed 21% of luxury ad expenditure, while the US accounted for 45%.

The Zenith report included subcategories of luxury automotive, fashion and accessories, and watches and jewellery.

Sparc Media opens up in Melbourne

The ad tech vendor has set up a new office to support its agency and direct ad business in the Australian city.

Headed by Kurt Holloway, who had been appointed Victorian state manager, the Melbourne office would service Sparc Media's existing media agency and direct advertiser customers in the city, as well as build new partnerships with media and creative agencies and direct brands.

Holloway was previously with News Corp, where he held various roles in the publisher's print and digital divisions and had led its digital marketing services unit, News Xtend.

Sparc Media's Melbourne team also comprises business development manager, Nick Smithwick, and senior account manager, Natashia Issa.

IMG acquires AU digital agency

IMG Global Investments (IMG) has acquired Australian digital marketing agency, Digital Logic Marketing Solutions, which operates in Melbourne and Sydney.

With the merger, the Australian agency would be folded into IMG's professional services subsidiary Treehouse.Global, according to Yolande Abeling, brand and marketing manager at Digital Logic, who noted that the agency was a partner of Salesforce Marketing Cloud.

IMG's global principal Ross Stewart added: "Digital Logic uses digital to drive business advantage at an omni-channel marketing level, while targeting significant business process improvement. This combination has a powerful impact on the client's results from a revenue and profit perspective."

Ad BlockingAdvertiserAPACAustraliaChinaIndiaMedia SpendMobileProgrammaticPublisherSingapore

Follow ExchangeWire