HP Balances Data Access with Retail Partners in Bid to Offer Omnichannel UX

Because a significant part of its hardware business is driven by resellers, Hewlett-Packard (HP) may not always have access to its customer data and needs to find ways to work around such limitations.

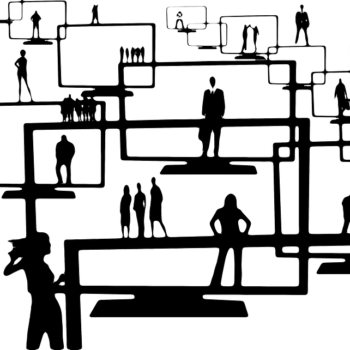

Over the last couple of years, as part of a company-wide strategy to better serve customers in an omnichannel environment, the IT vendor has been tweaking its systems and processes to deliver a consistent, personalised brand experience across all touchpoints, including offline and online channels. It operates 10 online sites in Asia-Pacific including Singapore, Japan, China, and India, and is targeting to include more markets into the mix next year.

Scott Basford, HP's Asia-Pacific Japan vice president of omnichannel, explained that customers today shopped differently from a few years ago, moving across devices and both the physical and online realms.

This underscored the need for businesses to bolster all their channels, such as direct online and traditional physical retail channels, including resellers and online marketplaces, Basford said, pointing to the likes of Harvey Norman, Amazon.com, and Lazada.

"When customers interact with us, they need to see the same information about our products, whether they're at HP.com or on a partner site or in a physical store", he said in an interview with RetailTechNews. "Customers also are demanding a personalised experience and don't want to contact the call centre and have the agent offer them a PC when they just purchased one the day before."

This personalisation also should apply online, where their shopping experience should depend on their purchase history with HP and how they previously navigated the site, he added.

Scott Basford, APAC Japan VP of Omnichannel, HP

In addition, the IT vendor has worked to simplify the customer's product-selection journey and remove friction points towards buying an HP product, he said, noting that HP is a large company and sold through many different channels. Basford acknowledged that, historically, the vendor had been channel-centric and approached the market through its partners, and not necessarily from the customer's perspective.

It now is looking to be more customer-centric by mapping customer journeys and trying to understand how consumers interact with HP, so it can identify and eliminate barriers, he said.

This also meant merging both offline and online realms to create a seamless experience, he added, noting that some of its larger partners already were introducing options such as click-and-collect.

In addition, e-tailers such as JD.com and Alibaba were moving into the brick-and-mortar space, he noted, further blurring the lines between both physical and online worlds. To help its smaller partners that sell exclusively HP products, he said the IT vendor will help them come online, as they might not have experience doing so.

While Basford declined to provide sales numbers detailing how much HP sold through its online channels and resellers, he said Asia-Pacific, including Japan, was its fastest-growing region. He added that, worldwide, partners helped push more than 80% of the vendor's business across all product categories.

Working around partner data limitations

Asked if it was difficult trying to better understand consumers when so much of its customer data sat with its channel partners, he said it was inevitable that everyone would be protective of their own data. In addition, these partners would need to manage data privacy concerns and policies, and this would limit the amount of information they could share with HP.

He admitted that it would be easier to run joint demand-gen activities, for example, if the vendor had access to customer data such as purchase history.

He noted, though, that all parties involved share the same objective – to improve and deliver quality customer experience. This would motivate partners to share key learning points with HP.

He added that the vendor also has a fair amount of data gathered from customers who bought directly from HP, as well as its install base of SMB (small and midsize business) and enterprise customers. It also will have data from customers who contacted the vendor at its call centres.

In addition, HP will conduct customer surveys and share the findings with its partners, some of which also would participate in customer-mapping exercises alongside the IT vendor.

Basford said: "So, when we sit down with our partners, it's about driving joint marketing activities. They won't release customer data to us, but we will find a way to run the exercise without [accessing that data]."

On its part, HP will track a customer's buying history as well as browsing history using cookies, he said, noting that consumers could choose to opt-in or out of receiving marketing material as well as to allow, or not, HP to track their browsing pattern.

The IT vendor uses the data to facilitate retargeting activities and push personalised ads to a consumer, he added.

Having access to key customer data also could, in future, power new services that provided additional value for customers, such as printers that could automatically place orders for ink cartridges to replenish its existing supply.

He again declined to reveal the volume of transactions HP processed via its online stores, but said these platforms collectively clocked some 10 million unique visits a month across the region.This content was originally published in RetailTechNews.

Ad TechAdvertiserAudienceCustomer ExperienceDataE-CommerceIn-storeOmnichannelPersonalisation

Follow ExchangeWire