ANA Study Reveals Strong Client/Agency Relationships

by Rebecca Muir on 30th Apr 2015 in News

ExchangeWire Research’s weekly roundup brings you up-to-date research findings from around the world, with additional insight provided by Rebecca Muir, ExchangeWire, head of research and analysis. In this week’s edition: the delicate relationship between brands and their agencies; a current trend for in-housing programmatic, 75% of marketers plan to increase programmatic brand spend and advertisers’ online performance marketing (OPM) ROI increases 6% to £15 per £1 spent, while four in five Britons online have used a website employing OPM techniques.

ANA Study Reveals Strong Client/Agency Relationships

The relationship between a brand and their media agency has always been a delicate one, hardly surprising given the enormity of marketing budgets and the expectation that said budget will drive even bigger revenues. However, results from the ANA’s ([US] Association of National Advertisers) survey report “Enhancing Client/Agency Relations 2015” reveals that the briefing process, approval process and compensation could be the main sources of discontent.

The study of marketers and agencies, which took place in Q1 2015, indicates that a clearer agency assignment process is needed. Just 27% of agencies, versus 58% of clients, reported that clients provide clear assignment briefs. Additionally, clients and agencies were not in agreement that the client approval process worked well – 54% of clients were satisfied with their current arrangement versus 36% of agencies. Compensation, typically a contentious issue, indicates only 40% of agencies believed it was fair, compared with 72% of clients.

Other key findings from the study included:

- Clients and agencies are lukewarm on the value procurement adds to client/agency relationships. Less than half of clients (47%) felt that procurement adds value, while only 10% of agencies agree.

- Clients (54%) and agencies (47%) agree that in-house client resources are increasingly becoming a realistic option for clients.

- Clients and agencies reported that agencies work well with other agencies, 65% of clients concur, versus a very robust 88% of agencies.

- Agency talent remains an issue. Only 56% of clients believed that agencies have the right talent to meet client needs over the next two years. Agencies are slightly more bullish at 64%.

- Despite their concerns the majority of both clients (87%), and agencies (86%) felt that the agency is a valued business partner that plays an important role in the client’s business strategy, and driving business results.

Bob Liodice, President and CEO of the ANA commented, “We are pleased to see that, at the core, client/agency relationships are sound. Having that strong foundation is a cause for optimism. However, there are disturbing legacy issues that continue to plague the partnership that have been further complicated by blossoming transparency concerns”.

75% of marketers plan to increase programmatic brand spend

However, financial transparency is biggest factor holding back level of programmatic spend, according to a survey conducted by programmatic advertising specialists, Infectious Media.

“These results highlight that brand marketers are now well aware of the benefits of programmatic advertising”, states Martin Kelly, Infectious Media’s CEO and co-founder. “It allows advertisers to use data to make smarter buying decisions and with large, premium ad formats now available programmatically it’s a shrewd investment.”

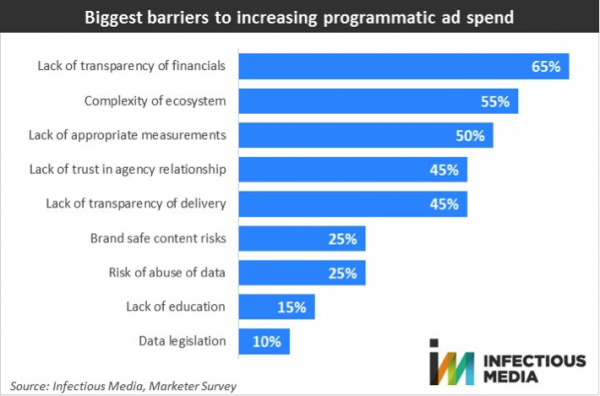

However, at the same time, two-thirds (65%) of marketers cite ‘lack of transparency of financials’ as the main barrier to really increasing programmatic ad spend.

“Although marketers plan to put more investment into programmatic, it’s clear transparency is still an issue”, explains Martin. “The IAB forecast¹ programmatic would account for nearly half of display advertising last year, so imagine how high it could be in 2015 if transparency wasn’t an issue.”

The complexity of the ecosystem (cited by 55% of marketers) and lack of appropriate measurements (50%) are the next most significant barriers to increasing programmatic spend. ‘Lack of trust in agency relationship’ and ‘lack of transparency of delivery’ were both cited by 45% of marketers.

Increasing sales is seen as the biggest advantage of programmatic (cited by 75% of marketers) followed by the ability to personalise ad messages and to make use of CRM data (both cited by 65%).

Marketers regard ‘synching of on and offline campaigns’ as the biggest opportunity (55%) around programmatic in the next 6-12 months, followed by ‘connecting up of new data sources’ (50%) and programmatic video (45%). Programmatic TV was cited by 40%.

“One of the holy grails of online marketing has always been to join up measurement of what we do online with what happens in the physical world of stores where many brands live”, states Martin. “In 2015 measurement of this type will finally start to become a reality”.

‘How to form a programmatic strategy’ is the area of programmatic marketers most want to know more about (85%) followed by the players in the ecosystem (65%) and how other businesses have been successful using programmatic (55%).

“Brands are struggling to build a programmatic advertising strategy that fits into a wider media mix and marketing plan”, states Martin. “It’s up to us as an industry to provide the guidance they need to overcome this challenge.”

To view the infographic, please click here.

To help marketers with programmatic, Infectious Media has released a best practice guide on how to ‘Grow Brand Awareness with Programmatic’.

Source:¹IAB UK: “Media Owner Sales Techniques” study

Consumers in the UK spent £16.5 billion in 2014 due to affiliate marketing and lead generation activities – 14% more than in 2013

According to the third annual Online Performance Marketing study conducted for the Internet Advertising Bureau UK (IAB) by PwC, UK businesses spent £1.1 billion on “Online Performance Marketing (OPM)” activities – 8% more than in 2013. This equates to a return of £15 for every £1 invested by advertisers – 6% higher than in 2013.

Across OPM sites – from large players such as Comparethemarket, Vouchercodes, Nectar and Quidco to the “long tail” of 12,000 smaller publishers in the UK – advertisers only pay a publisher for an ad if it causes someone to complete an action, such as a purchase (affiliate marketing) or submitting contact details (lead generation).

In 2014, consumers made 125 million purchases via affiliate websites – totalling £15.4 billion. £1.1 billion in sales was generated from the 30 million contact forms submitted. Consequently, OPM drives 10%¹ of all UK e-commerce retail sales and roughly 1%² of GDP – the latter, an approximate 34% increase on 2013.

“The fact that consumer spend is growing at nearly twice the rate of advertiser spend, indicates the OPM market is maturing and brands are becoming more efficient in how they drive consumer spending,” says Dan Bunyan, Senior Manager at PwC.

“OPM has grown to a near-£17bn industry due to the fact that all parties continue to benefit. Advertisers get new customers extremely cost-effectively, consumers save money and get access to free online content, whilst the publisher in the middle gets revenue through referral fees.”

The growth of this market is largely down to technology advances. It is now possible to integrate multiple sources of data so that every pound spent on advertising can be tracked to an outcome. Without this transparency, any media channel will struggle to grow and win budget against other channels. This is very encouraging for online advertising as a whole and many emerging channels can learn from the advances seen in OPM.

It’s not just about sales - OPM is a highly effective way to improve brand awareness.

The study by the IAB estimated that OPM generated 4 billion clicks which is approximately 120 clicks per second. From a consumer point of view, there is a general level of understanding of this advertising model, specifically 8 in 10 people claim to be at least partially aware of the price comparison site business model. Furthermore, 46% [of consumers] are "very willing" or "fairly willing" to share personal information to get cheaper / free products.

Dramatic upsurge in activity on mobile and tablets

In comparison to the overall 8% increase, advertiser OPM spend on mobile and tablets increased by 72%. Consequently, the share of OPM spend allocated to these devices increased from 11% to 17%.

Tim Elkington, Chief Strategy Officer at the UK’s Internet Advertising Bureau says: “Advertisers are heavily increasing OPM spend on mobile because it’s playing a bigger role in shopping. Half of adult smartphone owners buy something with their mobile every month, a quarter do so weekly.”

Three sectors account for three-quarters of spend

The finance sector, driven by insurance and credit card advertisers’ use of price comparison sites, is the biggest spender – accounting for 34% of OPM expenditure in 2014 – followed by retail (21%) and travel & leisure (19%). In total, these three sectors account for 74% of OPM spend.

OPM now an “ingrained part of today’s savvy consumerism”

An accompanying YouGov study shows that almost four in five (79%) Britons online³ have used a website employing one of the main OPM techniques in the last six months. Cashback websites are the most frequently used – around two-thirds (67%) of people who’ve used them do so at least once a month.

Holidays/travel (cited by 21% of respondents) is where people are most likely to be trying to save money or looking for more information, followed by energy tariffs (16%) and car insurance (15%).

“Britons generate 10 million clicks every day in pursuit of getting a better deal or finding the right product – it’s an utterly ingrained part of today’s savvy consumerism. To put it in context, at £17bn it’s already as big as the beauty industry⁴,” concludes Elkington. “The majority of people online say they’re aware how these sites make money, and whilst the privacy debate continues, the reality is that nearly half are willing to share personal information to get these things.”

¹Based on Verdict Retail (2014)

²Assumed GDP of c. £1.6 trillion (IMF, Oct 2014)

³Source: YouGov Plc. Total sample size was 2090 adults. The survey was conducted online between 16-17th March 2015. The figures have been weighted and are representative of all GB adults (aged 18+).

⁴Source: http://raconteur.net/lifestyle/business-face-of-uk-beauty

Thinking of taking programmatic in-house?

Finally, according to an Index Exchange report cited in Ad Age brands are taking their automated digital ad buying operations in-house. Share of spend from agencies, trading desks and tech company managed services are falling, whereas, in-house share of spend is growing.

There could be many reasons why programmatic spend is shifting from agencies or managed service buys, let’s begin by looking at what is required to execute programmatic buys. Firstly, you need someone who can create a media brief, if other media is being bought in-house, it is relatively easy add programmatic into the mix at the planning stage. Next, you need someone who can trade, this is probably the easiest part as, on the whole, DSPs are more than happy to work directly with brands. Finally, you need someone who can interpret campaign results and optimise future investments, this is the hardest part of the equation to do in-house.

This essential task requires previous hands-on experience, usually achieved by working at a trading desk or an agency. Generally speaking an optimiser working for an agency or a trading desk will work on many clients’ programmatic campaigns as the optimisation of a single campaign is not a full time job. This brings to light the first issue, there are more brands that could take programmatic in house than there are optimisers, and therefore, the salaries of these people can become over inflated as demand outweighs supply. Secondly, you can’t employ someone if you don’t have enough work for them to do; the alternative is to train an existing team member with capacity to take on more, however, then you’re missing out on the experience aspect.

So, while there’s currently a trend for programmatic buying to shift in-house, whether this is sustainable or achievable at scale remains to be seen.

AdvertiserAgencyDisplayExchangeWire ResearchMartechMedia SpendPerformanceTradingTrading Desk

Follow ExchangeWire