Strong Ad Spend Growth in 3 Asian Markets; APAC Expenditure on Audience Data Drops in Q3

In this weekly segment, ExchangeWire sums up key industry updates on ad tech from around the Asia-Pacific region – and in this edition: Three Asian markets to see strong ad spend growth; APAC expenditure on audience data drops in Q3; Eyeota opens Tokyo office; Dentsu Aegis to acquire Band in Singapore & HK; and Move & Emma integration to beef up AU home campaigns.

Three Asian markets to see strong ad spend growth

Indonesia, India, and the Philippines will be the only three markets worldwide to see double-digit ad spend growth next year, according to ZenithOptimedia's latest ad expenditure predictions.

Indonesia will lead the pack with 17% growth, expanding by USD$4.1bn, while India and the Philippines are expected to grow 13% each, expanding by USD$3bn and USD$1.2bn, respectively. Growth in these markets is expected to be fuelled by "sustained, healthy economic growth" and strong personal consumption, said ZenithOptimedia.

And while China's slowing economy is projected to pull down its ad spend growth to 7.5% in 2016, this climb will still outpace the global ad spend growth of 4.7%, noted the media agency. It added that Russia also will surpass the global figure, clocking a 5.3% growth rate next year, despite the country being currently in recession.

From 2005 to 2010, China registered an average 16.9% growth in ad expenditure, while Russia clocked 10.3%, ZenithOptimedia noted; adding that the global market's growth next year will be driven by technology advancements, particularly in mobile and programmatic.

Globally, programmatic ads will account for 60% of digital display ads in 2016, up from an expected 53% this year, according to ZenithOptimedia's latest programmatic marketing projections. The agency said spend on programmatic ads climbed from USD$5bn in 2012 to an estimated USD$38bn, by the end of this year.

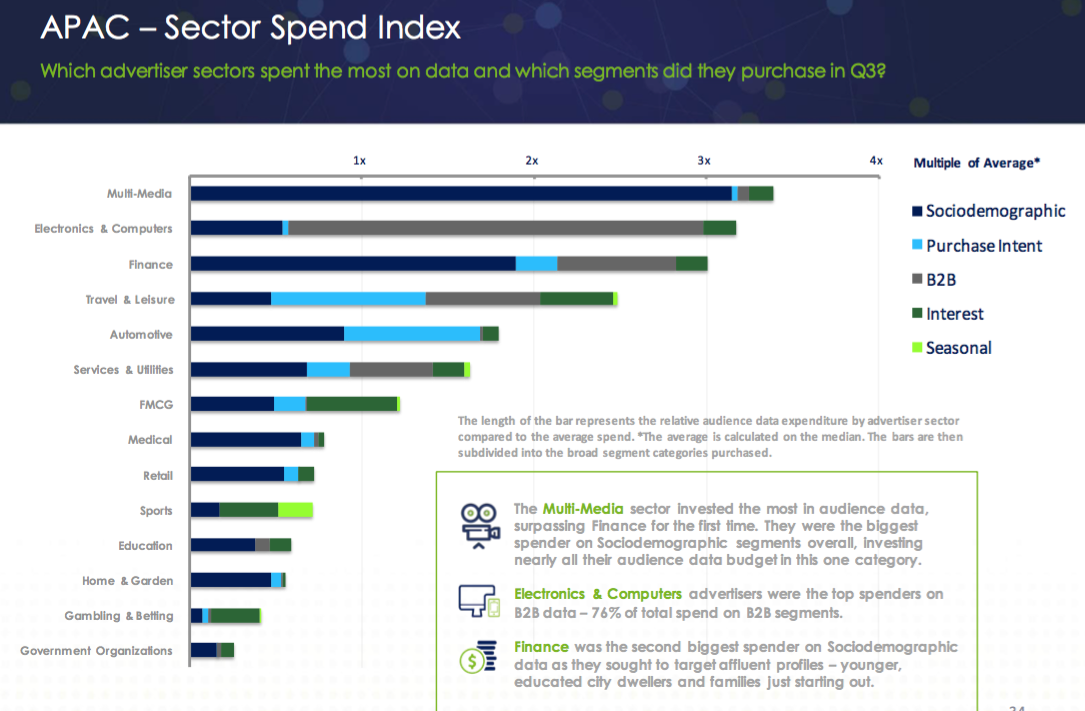

APAC expenditure on audience data drops in Q3

Spend on audience data in the Asia-Pacific region dipped 7% in the third quarter, over the previous quarter, dragged down by the Australian market and drops in the finance and automotive sectors. These two segments, though, still led overall spend for the year, said Eyeota, citing latest figures from its index, which measured growth, spend, and price from campaigns delivered across 60 countries.

Noting that Australia's financial year ended in the second quarter, the ad tech vendor said Australian advertisers would have fully consumed their budgets for audience data and started planning their budget for the new financial year.

Eyeota pointed to growth indications from new markets in the region, such as Vietnam, Japan, Korea, and the Philippines.

Reflecting global trends, the electronics and computers sector was Asia-Pacific's largest spenders of audience data and one of the top growth segments in the region. Advertisers in this space poured their budget into B2B data, revealed the index; which indicated software vendors targeted businesses of specific sizes, as well as tech professionals in Singapore and Australia.

Eyeota CEO Kevin Tan said: "The Southeast Asian market grew by 42% in the third quarter, on the back of a massive increase of 256% last quarter; which is still very promising as it shows how programmatic is just starting to take off.

"The continued growth in the region illustrates how brands are becoming savvier in using audience data for more effective targeting", Tan said.

Eyeota opens Tokyo office

The audience data provider opened its first office in Tokyo this week, as it looks to tap growing demand from the local market, which is the second-largest advertising market worldwide.

Eyeota said it would adopt a local approach for the Japanese market, partnering with local data providers, media agencies, and publishers. It added that it was currently developing products and would make these available "in the near future".

It also announced that it had appointed Nobuyuki Wakatsuki as its business development manager for Japan, where he will be driving the company's market growth. Wakatsuki comes with more than 17 years of experience in digital media, having worked at companies such as AOL, MSN, and Yahoo Japan.

He reports to Tan, who said: "Japan is a market where programmatic advertising is just taking off and audience data is only just starting to emerge. There is a lot of potential for growth in Japan.

"I hope Eyeota can work with publishers to continue providing quality third-party audience data with scale and reach to buyers in Japan", he said.

Dentsu Aegis to acquire Band in Singapore & HK

The Japanese media agency has announced plans to acquire Band's operations in Singapore and Hong Kong.

Founded in Singapore in September 2002, with its Hong Kong office set up a month later, Band offers B2B digital advertising and marketing services.

Following the acquisition, Dentsu said the Singapore-owned agency would merge with the former's Carat Enterprise, which manages the group's B2B efforts in the Singapore market.

Team from ASPAC Creative Communications

In a separate announcement this week, Dentsu said it had finalised its 70% acquisition stake in ASPAC Creative Communications in the Philippines, with the option to buy out the remaining share at a later date.

Dentsu Southeast Asia Chairman and CEO Dick van Motman said: "We've seen great potential for our business in the Philippines to expand on our creative talent and services. This acquisition is a strategic investment to further grow our footprint in the local scene and to continue to strengthen our presence in the sixth-largest advertising market in Asia-Pacific."

Miguel C. Ramos would remain as ASPAC Chairman, while Susan Dimacali and Angel Antonio also would retain their positions as CEO and COO, respectively.

Move & Emma integration to beef up AU home campaigns

Outdoor Media Association (OMA) has selected Ipsos as its preferred partner, which will see the integration of the latter's cross-platform audience survey, Enhanced Media Metrics Australia (Emma), with OMA's measurement platform Move (Measurement of Outdoor Visibility and Exposure).

Integration work would begin late-2015, with data slated to be available to media agencies, advertisers, and outdoor media companies early next year to better facilitate their OOH campaign delivery, said OMA.

Ipsos was chosen after a process in which three other research firms also participated. "Fusing the two metric systems will enable subscribers to cross-tabulate all of Emma's media, demographic, attitudinal, lifestyle, and product consumption variables against the formats measured by Move", the vendor said; noting that this would give media planners deeper insights on OOH's reach by specific demographics.

It added that its geo-demographic audience profiling tool, GeoEmma, also would be integrated with Move, providing more comprehensive local-area marketing data.

Move's general manager Grant Guesdon said: "Fusing Move data with Emma is a great opportunity to show outdoor's reach, especially across different lifestyles and consumers. In the current media climate, OOH has the power to reach the people other media find hard to get.

"A cross-media analysis in Emma, through Move, will help agencies and clients identify the value of this to their campaign and, more importantly, help advertisers better plan their investment decisions", Guesdon added.

AdvertiserAgencyAnalyticsAPACAustraliaDataDOOHIndiaLocationMeasurementMobileProgrammaticPublisherSingaporeTargeting

Follow ExchangeWire