The 'Great Fragmentation' is Here: A Glorious Opportunity for the Industry & Investors

by Ciaran O'Kane on 2nd Oct 2020 in News

These are strange times, readers. COVID continues to tear away at the socio-economic fabric of the world. The once noble institutions of the ad tech ‘POWA’ breakfast, and the extended media lunch, have been reduced to sad Zoom/Google Meet/Microsoft Teams calls. And to top it all off, our industry is slowly being chewed alive in the cookie crunch.

I’ve always been a contrarian by nature. When things are going well, I am deeply sceptical and fearful of unseen disasters. When things have gone to absolute shit (like currently), I am hopeful and full of optimism that solutions can be found.

Today I am going to that optimistic zeal and turning the pervasive gloom of cookie deprecation on its head. I see this ‘great fragmentation’ in digital marketing as a glorious opportunity to build great new businesses, capturing value from Google, Facebook, and Amazon who have literally ravaged this industry.

What is this ‘great fragmentation’?

Most readers will be aware of the privacy and technology headwinds buffering the digital ad industry. To summarise quickly: the currency, namely the third-party cookie, we used for measurement and targeting is going away.

The common ID is no more. Sure there will be ID replacements, but ultimately we are looking at a more chaotic and fragmented landscape.

This will have profound implications: media spend will be re-allocated; measurement and targeting options will need to change or evolve; and a lot of cookie-based ad tech will die. It will, in short, be a total recalibration for the entire industry.

But fret not, dear reader, because this chaotic maelstrom will have significant upside for both smart new businesses and savvy investors.

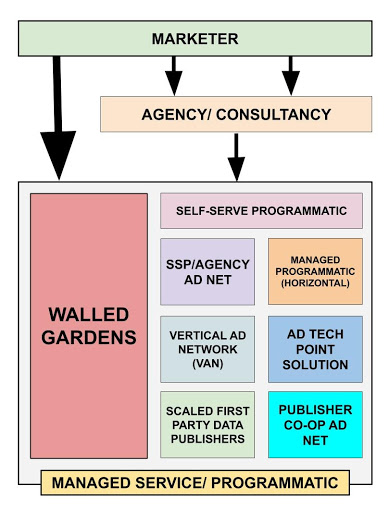

Before I outline the models and businesses that win in the ‘great fragmentation’, the graphic below outlines where I think money will flow in this redrawn landscape.

It must be pointed out first that there is a deluded misconception that a more fragmented environment helps Google, Facebook, and Amazon increase market share; inevitably grabbing spend from the twenty percenter’s pot (i.e. those companies that make up non-GAFA digital ad market share).

It’s time we call bullshit on that observation - especially when that thesis is framed around the marketing spend that comes from holding groups, independent agencies, and top-tier brands.

There are three key reasons why they won’t get the whole pie:

- Agencies cannot be seen by clients to be giving all of their media spend to the walled gardens, since it would be tantamount to commercial suicide - particularly around renumeration and necessity;

- Despite what you might think, people actually consume digital media outside Google, Amazon and Facebook;

- The walled gardens are just as challenged by ID and cookie deprecation, as it ultimately restricts them to their UGC (user-generated content) slums.

The chart shows that there will be opportunities for the twenty percenters in the fat- and mid-tail of media spenders. Forget about the long-tail, because you will never beat the scale and reach of Google, Facebook and Amazon.

So, who is going to benefit from this ‘great fragmentation’?

Measurement. Measurement. Measurement.

I am going to tell you the worst kept secret in ad tech: contextual works just as well behavioural targeting; not a bad thing, given we are all heading into a cookie-less future.

The obvious problem though is not targeting, it’s how we measure KPIs. With the sunsetting of third-party cookies, it’s going to become very difficult to measure the effectiveness of online display. Post-view is dead. And that is a problem for all of us.

For me, measurement is the biggest opportunity in ad tech right now. But there are very few willing to take it on. Sure, there are vendors trying to build measurement around first-party cookies, but that is going to be difficult to scale (and that’s where I see VANs [vertical ad networks] filling the gap).

The most prescient words I have heard from anyone in this space, said about this space, was from IPONWEB CEO Dr Boris Mouzykantskii. During an on-stage conversation with me at ATS Singapore in 2019, he suggested we move back to a panel-based system.

This seems like a backward step for the industry. And maybe it is. But there is always wisdom in Dr Boris’ words (he’s a nuclear physicist and ad tech genius after all). We need to reimagine measurement and attribution. We need to re-architect this around reliable signals and not a hacked cookie-based solution - and that could be panel-based data or something else.

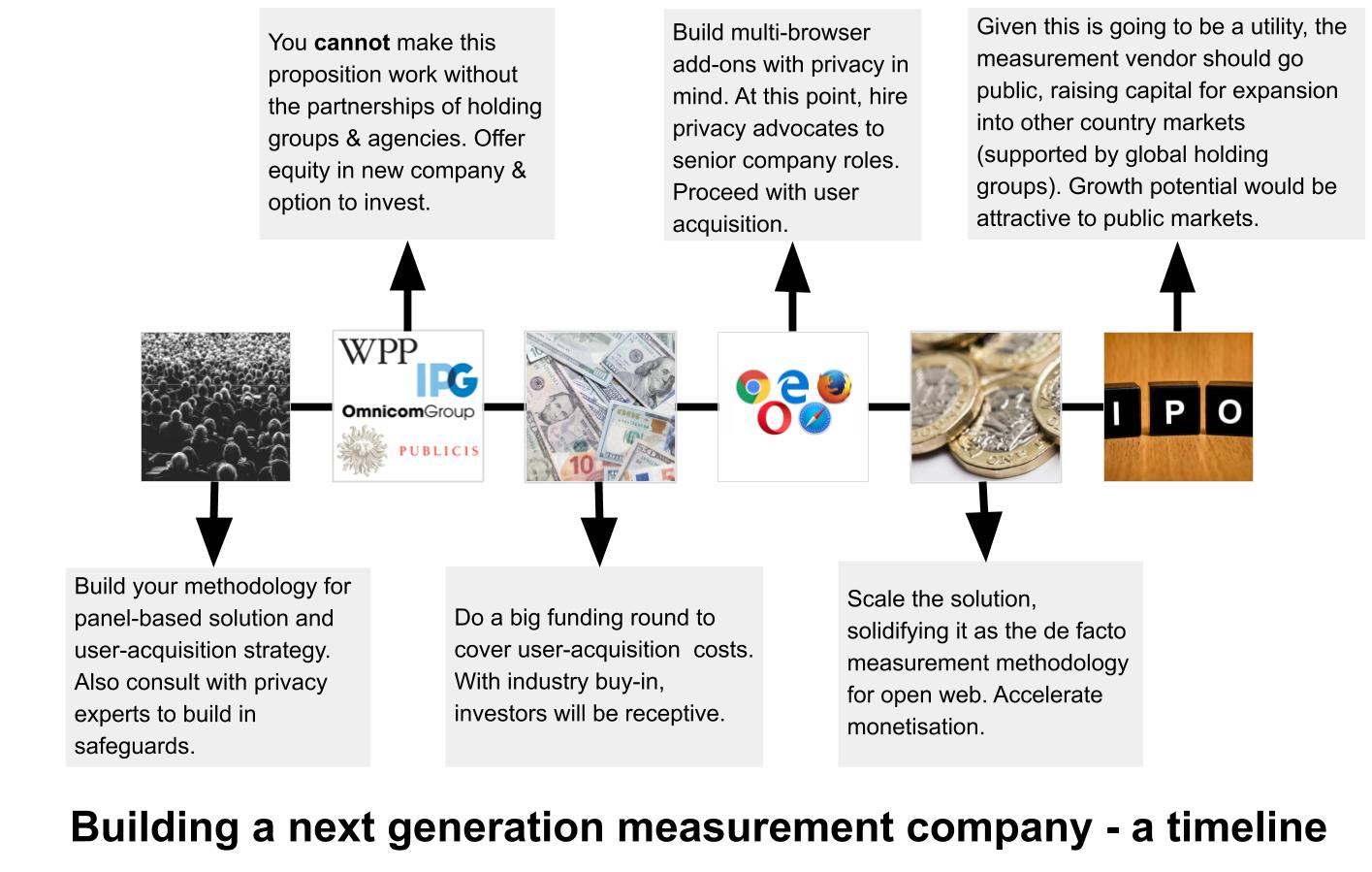

In the meantime, here is an outline of a panel-based solution I came up with, blending analogue with digital. You are free to take this idea and build it out; just be sure to come to me about investment and advisory roles.

Introducing the panel-based browser solution (PBS):

- Build a country-specific measurement solution that works with all browsers and operating systems across mobile and desktop (a script-based solution built into browsers);

- Before even starting on this journey, you need agreements with all holding groups and leading agencies to make this the de facto measurement solution for the open web;

- Offer holding groups and agencies equity in the new solution with the view of going public;

- The PBS can only focus on measurement;

- Incentivise payments to acquire users (annual fee) with the objective of securing required demographics to build your national panel;

- This has to be a privacy-first solution so that users understand how their data is being used;

- With that in mind, hire a data-privacy advocate (Johnny Ryan perhaps) to run comms and user outreach;

- The panel needs to be scaled, covering enough of the market;

- Monetisation would come from a CPM charge baked into all open-web buys.

The beauty of this is that you could easily have one of these in every local market, opening up a huge opportunity for measurement startups. So what are you waiting for? Get building it.

Vertical Ad Networks

In a cookie-less world, audiences are going to be hard to access. You will get some access to horizontal buys via the walled gardens and ID-based programmatic. But there will be blind spots. Agencies and marketers will seek out granular audience buys elsewhere. One segment that’s going to get increased marketing spend is the Vertical Ad Network (VAN).

There is going to be a wave of new VAN solutions coming to the market, as buyers go hunting for hard-to-find audiences. The idea of the VAN is a simple one: namely, aggregating publisher inventory in specific verticals using a mix of first-party cookies, contextual, and third-party technology. I wrote about the VAN model earlier this year on ExchangeWire if you are interested in getting more detail on the model.

With the demise of the third party cookie, there is likely to be some ‘creative hacking’ of both targeting and measurement - an obvious opportunity for a sell-side platform solution provider.

These VANs are already active in the market; notable examples include the recently acquired SuperAwesome and gaming media specialist, Venatus.

The ‘great fragmentation’ will result in a splintering of media spend. Smart industry operators will seek out audience verticals, building businesses on strong publisher relationships, vertical-audience specialism and managed-service expertise.

There will be many verticals to choose from. My favourite is the fast-growing health and wellness segment, a relatively untouched multi-billion dollar marketing opportunity. A thousand VANs will be driving your way soon.

Ad tech point solutions

It’s never been a better time to be an ad tech point (ATP) solution. The shrinking ad tech execution layer means all the future value in the sector will be on the periphery. Whether it's a contextual or an audio solution, buyers will be seeking out suppliers to address the many issues in the ecosystem. I see the ATP offerings coming in two flavours: one, the plug-and-play solution that works with the existing ad tech infrastructure; and two, a managed service that puts agency and marketer money to work.

ID solutions

There is no doubt that the ID vendor segment has been the breakout success in ad tech over the past 12 months. Europe’s aggressive privacy pivot has led to a number of new solutions that are helping digital marketers navigate the restrictions around data use. I won’t go too deep on this, as I have already posted an extensive piece on ID vendors on this blog. You can read more here. If you have a robust privacy-first ID, you are going to do well.

Scaled publisher co-ops (brand buys)

Ozone has been quietly building its publisher co-op solution in the UK for the past 24 months. It started off helping publishers by managing its Prebid.org integrations. It has since graduated to a scaled managed service - specifically around cookie-less brand buys. Ozone is going to be the template for publisher groupings in other markets. I see these evolved co-ops driving significant additional brand spend, helping publishers stave off drops in cookie-based revenue.

Anyone with first-party data

Logged-in data is going to be king in the new cookie-less world. Passer-by traffic will be harder to monetise, and inevitably yield will drop. Those publishers who can get users to log in at scale will have vibrant ad businesses. And as new ID solutions emerge to join disparate data sets, the opportunity to attract more spend will present itself.

Agencies and managed-service solutions

As I said on our recent ExchangeWire webcast, fragmentation is the managed-service provider’s best friend. Marketers are going to lean heavily on agencies and other specialists as the in-house narrative gets relegated to trade press archives.

The ‘great fragmentation’ is here. But many in our industry seem desperate to save the existing third-party cookie infrastructure. Unfortunately it is too late. The horse has bolted. And browsers will soon own all the privacy functionality. We need to accept this inevitability. By understanding the game has changed, we as an industry can reshape and evolve this business. Keep GAFA confined in their UGC hell-holes; we can run the rest.

Ad NetworkAd TechAmazonContextFacebookGoogleIdentityMeasurement

Follow ExchangeWire