Baidu Among Top 5 Global Media Owners; Digital Ads to Outpace TV in HK & TW

In this weekly segment, ExchangeWire sum up key industry updates on ad tech from around the Asia-Pacific region – and in this edition: Baidu among top five global media owners; Digital ads to outpace TV in HK & TW; IAB AU tout CEASA data on ad spend; Handbook to guide marketers on data strategy; Dentsu aim to boost data capabilities with Accordant; Executive appointments at media agencies; and Tune Group & Emirates marketers join WFA committee.

Baidu among top 5 global media owners

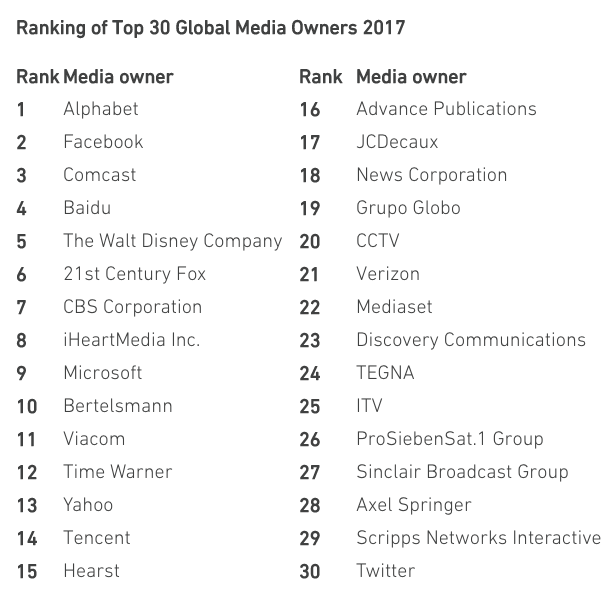

Chinese search giant Baidu are among the top five global media owners, which also include Google, Facebook, Comcast, and The Walt Disney Company.

Google and Facebook alone accounted for 20% of global ad spend across all media last year, up from 11% in 2012, and generated 64% of total ad spend growth between 2012 and 2016, according to Zenith's Top 30 Global Media Owners report. The study focused on media owners' revenues from advertising, excluding revenues from all other activities.

Google's holding company Alphabet led the pack, grabbing USD$79.4bn (£61.28bn) in ad revenue last year, which was three-times larger than second-ranked Facebook's USD$26.9bn (£20.76bn). Placed third, Comcast was the largest traditional media owner and raked in USD$12.9bn (£9.96bn) in ad revenue.

(Source: Zenith’s Top Thirty Global Media Owners report)

Digital platform owners funded by internet advertising dominated the top 30 list, which – apart from Alphabet and Facebook – included five other pure-internet media owners: Baidu, Microsoft, Yahoo, Verizon, and Twitter. Together, the seven digital platforms churned USD$132.8bn (£102.49bn) in online ad revenue last year. This figure accounted for 73% of total online ad spend and 24% of global ad spend across all media.

According to the report, Twitter was the fastest-growing media owner, clocking a 734% climb in ad revenue between 2012 and 2016. Tencent came in second, with a 697% growth rate over the same five-year period, followed by Facebook, at 528%.

Baidu and Sinclair Broadcast Group also more than doubled in size, growing by 190% and 171%, respectively, between 2012 and 2016.

Digital ads to outpace TV in HK & TW

Digital ad spend will outpace TV in five additional markets this year, including Hong Kong and Taiwan, as marketers follow where their consumers take them.

Worldwide, digital ads would account for 77¢ of every new ad dollar in 2017, with TV contributing 17¢, according to forecasts in GroupM's Interaction 2017 report.

"Despite challenges around standards, measurement, and supply chain integrity, digital advertising continues to grow rapidly as marketers follow consumers to the media destinations where they spend their time and, increasingly, transact for goods and services", the report noted.

Digital ad expenditure already outpaced TV in 10 markets, including Australia, China, and the UK; and another five were projected to see a similar trajectory this year. Apart from Hong Kong and Taiwan, GroupM said France, Germany, and Ireland also would see digital platforms taking a larger portion of ad dollars than TV.

TV, however, still ruled the global ad world, generating 42% of overall spend in 2016 and was expected to decline slightly to 41% this year.

The report added that consumers globally were spending more time on online media, which grew by 14 minutes in 2016, compared to the average growth in media by nine minutes. This was fuelled by adoption of mobile technologies that provided greater access to media.

Adam Smith, GroupM's futures director, said: "Google and Facebook attracted the vast majority of incremental digital ad investment growth in 2016. In 2017, the industry will be watching closely to see how Snapchat or Amazon may creep into Facebook's and Google's value chain; and if the stronghold that BAT (Baidu, Alibaba, Tencent) has in China can expand to international markets."

IAB AU tout CEASA data on ad spend

Over in Australia, industry group IAB are lobbying statistics from Commercial Economic Advisory Service of Australia (CEASA) as a more accurate indication of the country's ad market, compared to data from SMI.

Citing figures from CEASA's 2016 report, IAB Australia said digital accounted for 48.6% of overall ad spend last year, compared to 42.5% in 2015. Traditional free-to-air TV contributed 21.6% of total ad spend in 2016, down from 24% the year before.

Mobile accounted for 15% of total ad spend last year, up from 11% in 2015, while digital video contributed 5%, compared to 3% in 2015.

IAB Australia said the CEASA report included ad revenue from all major paid media channels using data sources that included ThinkTV, Outdoor Media Association, IAB, and Commercial Radio Australia, as well as data from all agency groups.

Comparing CEASA's report to SMI's data, IAB said the former included ad revenue from all major paid media channels and data from various sources including advertisers. On the other hand, SMI looked at ad revenue from most large media agency groups, but excluded all IPG Mediabrands agencies and did not consider advertiser spend.

IAB Australia's research director Gai Le Roy said: "As the stakes increase, it is important that cool heads prevail and we rely on independent data from organisations such as CEASA for media planning decisions, rather than from incomplete sources.

"To understand the whole media market, we must have data on direct advertiser spend and not just selected agency data. Without this, we are missing almost all SME advertising spend, as well as that of the larger advertisers that are taking more of their buying and planning in-house", Le Roy said.

Handbook to guide marketers on data strategy

In a separate announcement, IAB Australia said they produced a Digital Data Best Practice Handbook to offer guidance around the use of data, including how to collect, store, and manage it. The handbook also discussed the benefits of using data to support creative design and marketing campaigns, as well as highlighted skillsets organisations should acquire to deal with data more effectively.

The handbook further comprised a section on 10 questions companies should ask in identifying the right vendors to work with, including data collection and privacy.

IAB's executive consultant and technology council co-chair, Jonas Jaanimagi, said: "The amount of data available, and its usage, is ever increasing; so it can be overwhelming when looking to incorporate a digital strategy around data. Having a simple plan around what you and your business intend to achieve by being more data-driven is critical, whether you are a publisher, marketer, or agency."

Dentsu aim to boost data capabilities with Accordant

Dentsu Aegis Network have acquired marketing agency Accordant in a bid to boost their capabilities in data-driven marketing.

The Australian agency was founded in 2014 and is a certified Adobe business solutions partner, specialising in using data to target and personalise customer experience.

Dentsu Aegis Network Asia-Pacific CEO Nick Waters said: "The market now provides the opportunity for brands to develop much more personalised customer experiences; but to do so requires a command of data, technology, and creativity. Accordant have deep specialist capability in this combination that delivers superior business results for clients."

"The business will integrate with our other agencies to offer clients a cohesive offline-to-online communications opportunity. We think this can be a powerful proposition in the Australian market", Waters said.

Executive appointments at media agencies

Christina Lim, MD, Dentsu Singapore

Dentsu Singapore have appointed Christina Lim as managing director, effective May 15, when she will join the agency after spending a decade at local supermarket chain, NTUC FairPrice, as director of brand and marketing.

She would report to Dentsu Aegis Network Singapore CEO Rosalynn Tay, who had held the dual roles as Dentsu Singapore CEO.

Lim has some 30 years of industry experience and previously held positions in Publicis Singapore, TBWA Singapore, and Havas Worldwide Singapore.

Meanwhile, in Australia, OMD have created a new role for Antonia Glezakos, who is promoted to Melbourne general manager, after eight years with the agency.

The appointment reflected OMD's growth in the market over the past year, becoming the largest media agency in the Australian city, they said.

Tune Group & Emirates marketers join WFA committee

Executives from Tune Group, Emirates, and L'Oréal are among new additions to the global exeutvie committee at the World Federation of Advertisers (WFA).

Margaret Au Yong, director of media at Malaysia's Tune Group, whose subsidiaries included AirAsia; and Boutros Boutros, Emirates' divisional senior vice president of corporate communications, marketing, and brand; and Lubomira Rochet, L'Oréal's chief digital officer were among new appointments announced at WFA's annual general meeting in Toronto last week.

According to the industry group, their executive committee comprise 40 representatives from various markets including India, China, Germany, and Russia.

Ad TechAdvertiserAPACAustraliaChinaDataFacebookMedia SpendMobilePublisherSingapore

Follow ExchangeWire