5 Asian Cities Among Top Ad Growth Drivers; AU Advertisers Not Seeing Full Returns

In this weekly segment, ExchangeWire sum up key industry updates on ad tech from around the Asia-Pacific region – and in this edition: Five Asian cities among top ad growth drivers; AU advertisers not seeing full returns; IAB AU join global industry group; Outbrain trial publisher revenue tracker in Singapore; Dentsu tap Vietnam JV to boost digital support; and VML open Singapore centre of excellence

Five Asian cities among top ad growth drivers

Ten cities are expected to contribute 11% of the growth in global ad spend between 2016 and 2019, with five located in the Asian region.

Jakarta, Tokyo, Shanghai, Manila, and Beijing were among the list of 10 global cities projected to be major growth drivers of ad dollars over the forecast period, according to Zenith's latest Advertising Expenditure Forecasts.

Some USD$61bn (£48.91bn) last year was spent targeting the population of these 10 cities; and this figure was expected to climb to USD$69bn (£55.32bn) by 2019. The top 50 cities would account for 27% of total growth, while the top 250 would contribute 50%, noted the Zenith report.

New York would lead the pack, attracting USD$15bn (£12.03bn) of ad dollars this year, followed by USD$13bn (£10.4228) in Tokyo, and USD$9bn (£7.22bn) in Los Angeles.

In estimating the value of cities to advertisers, Zenith said they assessed the amounts spent targeting the city's population, including their surrounding metropolitan areas, by ads in local, national, and international media.

Zenith's head of forecasting, Jonathan Barnard, explained: "Population numbers, productivity, and disposable incomes are rising faster in cities than elsewhere, so city dwellers are becoming more valuable for advertisers seeking growth. Big cities are now driving growth in ad spend."

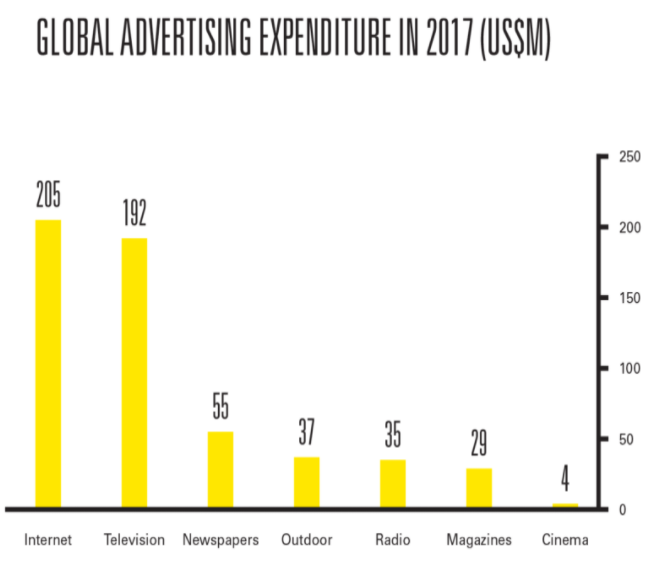

According to the report, global online ad spend would climb 13% to hit USD$205bn (£164.36bn) this year, marking the first time more money would be spent online than on traditional TV. Internet ads would account for 36.9% of all ad expenditure, compared to 34% last year. Some USD$192bn (£153.94bn) would be spent on TV ads this year.

The growth rate of online ads, though, was expected to slow to 13% this year, compared to 17% in 2016, and 20% in 2015. This would further drop to 12% in 2018 and 10% by 2019.

"In this environment, it is vital that platforms and publishers address advertisers' valid concerns about viewability and brand safety to secure sustainable growth", said Zenith. "As the market matures, advertisers need to know for certain their ads are being actively viewed by real people in appropriate environments."

Zenith's Advertising Expenditure Forecasts

AU advertisers not seeing full returns

Less than half of every dollar Australian advertisers spend programmatically goes to publishers, according to findings from research firm Ebiquity.

Publishers received just 40¢ of every dollar, with other intermediaries in the media buying chain getting the remaining 60%, without being able to quantify the value they provided for the brands, said Ebiquity's chief strategy officer Nick Manning, in a report by The Australian.

"From advertisers' perspective, they pay AUD$100k for a campaign and only get AUD$40k of media. Then the problems start, as viewability and fraud reduces even this by roughly half, on average, so the AUD$100k actually equates to AUD$20k of useful media", noted Manning, who also discussed the findings at a conference hosted by the Australian Association of National Advertisers (AANA).

"The 60% shrinkage is a combination of technical fees, data fees, markups, and agency commissions and rebates across the various providers, which are paid on an impressions currency – whether those impressions are seen or not", he added.

He urged marketers to look at what they were getting for their ad dollars when they purchased on programmatic platforms, and underscored the need for measurements of digital ads to be scrutinised.

Manning said: "The real question, ultimately, is whether online advertising is working. In many instances, we find it is not performing as it should or delivering a positive return." He added that advertisers were not spending adequate time reviewing issues related to their programmatic buys and determining whether these were good investment.

Pointing to increasing concerns among marketers that some agencies had agreements with media sellers to direct budgets towards their inventories, he said advertisers should assess all available options and decide what worked best for them. They also needed to understand the economics of programmatic.

The AANA said it would tap Ebiquity's research to aid their efforts in increasing visibility across Australia's media-buying ecosystem.

IAB AU join global industry group

IAB Australia now are an affiliate member of the international group Coalition for Better Ads, which aim to improve online ad experience.

Launched in Germany last October, the global industry group comprised trade associations, publishers, agency groups, and brands including Procter & Gamble and Unilever. The group last week released their first set of 'Better Ads Standards' for North America and Europe, encompassing guidelines for desktop and mobile web. These were established from research involving more than 25,000 consumers who rated 104 ad experiences, while reading online articles on desktop and mobile platforms.

The coalition also unveiled plans to conduct similar research in Australia, which would lead to local guidelines for marketers, agencies, and publishers.

IAB Australia CEO Vijay Solanki said: "We are continuing to strongly drive every available option to help simplify and improve the online advertising experience for consumers and to improve the advertising value for brands." He further stressed the importance of collaboration in achieving this goal.

Unilever CMO Keith Weed added: "As an industry, we have a responsibility to find better ways of making great advertising and content that really engages people. It's in everyone's interest.

"Better advertising leads to a better experience for the viewer and more effective advertising for brands. The work of the coalition to identify consumer preferences around ad formats will be a highly useful and insightful tool for the brand builders, advertisers, and advertising agencies working to improve the quality of advertising for the viewer, while driving effectiveness and efficiencies for the brand", Weed said.

Outbrain trial publisher revenue tracker in Singapore

Singapore Press Holdings (SPH) will be the first publisher in Asia-Pacific to trial Outbrain's Automatic Yield technology, which is touted to facilitate real-time tracking of inventory revenue.

The tool would provide various information of a publisher's revenue, matching real-time revenue value to owned content a publisher pushed across their site, said Outbrain. The ad tech vendor added that this would enable publishers to monetise audiences based on "immediate understanding" of all of their content through a centralised dashboard.

Outbrain's Asia-Pacific vice president of Engage, Sigrid Kirk, said: "There has never been a way for publishers to really understand or measure the value of each and every piece of content they produce and publish. Automatic Yield answers that question and enables them to make critical decisions about what content is most valuable, what content to produce, to promote, and distribute, and how to most effectively monetise that content.

"Publishers can now manage their content and traffic to maximise both user engagement and revenue", Kirk said.

Dentsu tap Vietnam JV to boost digital support

The Japanese agency group have set up a joint venture in Vietnam to meet growing demands for digital marketing services in their domestic market.

Called Dentsu Techno Camp, the new company would be operational from April 1 this year and was established together with Evolable Asia, which specialised in IT offshore development services in Vietnam.

Amid growing demand for digital marketing services, the number of programmers, systems engineers, and other developers in Japan had been falling. Coupled with the country's declining birthrate and ageing population, recruitment and skills retention had become a significant human resources challenge.

This led to discussions about the need for an organisation that could effectively support the development and management of a wide range of solutions, Dentsu said. Specifically, to meet growing demand for websites, smartphone apps, amongst others, there was an urgent need to boost service operations necessary to integrate design, screen specification creation, coding, image processing, and verification.

The launch of Dentsu Techno Camp would provide the services and support necessary to facilitate the delivery of digital marketing services, the agency said.

In a separate announcement, Dentsu Aegis Network said they had appointed Keith Ho as chief creative officer of their Hong Kong outfit.

Formerly CEO of Grey Group Beijing, Ho has more than 25 years of industry experience and will report to Dentsu's Hong Kong president, Judy Kong.

Tripti Lochan, SEA & India CEO, VML

VML open Singapore centre of excellence

The WPP media agency have launched a Centre of Excellence (COE) for their platforms and experiences practice in Singapore, which is one of three such facilities worldwide.

The centre would house at least 40 new hires across various segments, including user experience, analytics, and digital consulting. According to VML, the practice was projected to contribute more than 40% of their overall revenues and had led digital transformation initiatives for clients such as Mediacorp and Kotak Mahindra Bank.

VML's Southeast Asia and India CEO Tripti Lochan said: "The establishment of the Centre of Excellence is a significant step in us being able to develop talent, best practices, and industry standards; which all come together to deliver the best experiences to our clients' consumers."

The other two centres were located in Kansas City and London.

Ad TechAdvertiserAgencyAPACAustraliaChinaMedia SpendMobileProgrammaticPublisherSingaporeViewability

Follow ExchangeWire