The State of Display Advertising in the Nordics (and how it's connected to salmon) by Tanja Sanders, MD, myThings

by Romany Reagan on 22nd Aug 2012 in News

Tanja Sanders is Managing Director, International at myThings.

I love Salmon. This wonderful fish is one of the best ambassadors of Nordic excellence. However, it can also illustrate a case in point I’d like to make regarding the state of display advertising and E-commerce in this region. How so?

Before I go back to maritime culinary delights, let's inspect an inherent contradiction in the Nordic markets.

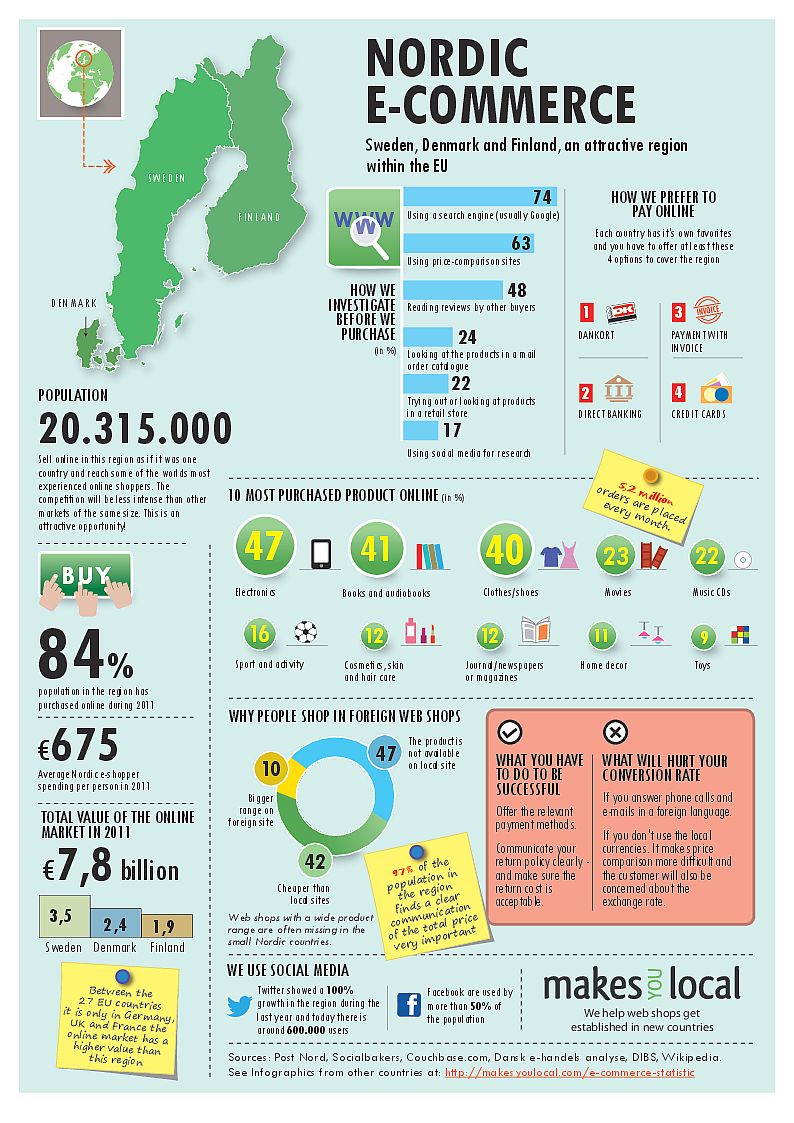

On the one hand, e-commerce in the Nordics is booming and slated to account for almost €11bn in revenues per year, the 4th largest in the EU! More than eight in ten Nordic consumers shopped online at least once last year, each spending an average of €675 per annum. Here's a great infographic illustrating this:

The region is also known for its early adapters and innovative technologies: Skype, Rovio (Angry Birds), Rebtel and Spotify, to name a few. Nordic marketers are also considered highly savvy when it comes to search marketing.

On the other hand, when it comes to display advertising, the market is far from leveraging the latest disruptive advancements in this area. Whereas personalised retargeting – one of the most effective ad optimisation methods – is on its way to achieving mainstream status in other EU countries, it has failed to gain ground in the Nordics.

Why is it that despite such a dedicated customer base, digital marketers in Nordic countries are not cashing in on the industry’s full potential?

Speaking to myThings from Gothenburg, Fredrik Strauss, a member of the Automated Trading & RTB task force at IAB Sweden and co-founder of Admeta, explained that the Nordic market is dominated by the short tail, especially three central media houses: Bonnier, Schibstedt and Sanoma. The adoption of ad exchanges and automated trading in the region is not common practice.

Other factors that can explain the discrepancy, according to Strauss, include:

Past experience with untargeted display campaigns: Display was booming 7-10 years ago but eventually many publishers and advertisers were disappointed by the results, as volumes were low and optimisation was not based on performance.

- Market share: Advertisers in the region consider television as the most important and effective channel, by far. Whereas TV dominates ad spend across many markets, TV's share in the Nordics is unusually high. Many marketers have gotten used to putting most of their eggs in the TV basket (and some in the search basket). This can be explained by existing relationships between the dominant players in the market and their disappointment in display during its untargeted era.

- High CPM and CPC rates: Prices in the Scandinavian market are rather high, and that has become somewhat of a standard. As a result, many advertisers consider other media sources like TV and print.

- Fragmented e-commerce landscape: With many brands operating in the market, customer loyalty is low.

One of the things salmon is famous for is the fact that it swims upstream, against the river's direction. It can be tough to swim against market trends and currents, as traditional players set the tone.

However, this can change and all players can benefit, advertisers, publishers and agencies alike. To achieve the kind of performance and conversion rate uplift, as other mature European markets have seen from display, Nordic marketers can begin by focusing on two central courses of action.

First, they should explore and test the disruptive technological advancements in performance display. Poor design, one-creative-fits-all and user bombardment gave display a bad reputation, but that's a thing of the past – at least for those who do it right.

The industry at large learned from its mistakes and evolved, generating pinpoint targeting at scale, agency-standard creative, strict frequency cappings, and as a result enhanced performance. It is why display's market share has been rapidly growing. In fact, according to eMarketer, display is projected to surpass search as the leading online marketing channel by 2015.

As marketers and e-commerce managers in the Nordics spend most of their marketing budgets on offline channels or search, the share of lost prospects is high. One of the ways to tackle this with display is via personalised retargeting, which has seen impressive growth in last 2-3 years. The ability to reconnect with lost prospects (about 98% of website visitors) and show them personalised content in real time has had a significant effect on performance (10X increase in conversion uplift compared to untargeted campaigns, on average).

Secondly, digital advertisers should introduce real time bidding to display ad campaigns: automatic selling and buying of display advertising in real time is a major reason for the explosion of display. The sheer scope is mind-boggling, with billions of such auctions carried out every day on multiple ad exchanges.

In order to fully leverage RTB and data-driven display, an advertiser – directly or through its service provider – must be able to analyse big data into accurate user valuations. With nearly infinite granularity in audience segmentation, RTB enables advertisers to pay the right price for every impression. This can help advertisers optimise their ad spend and improve their cost-effectiveness and ROI.

Last but not least, a word for publishers. Taking advantage of the disruptive advancements in RTB will enable them to fully optimise their remnant inventory, which accounts for approximately 30% of online ad real estate. Optimising 30% of their inventory can have a significant impact on revenue. RTB platforms also enable publishers to set pricing on their inventory, which is a good yield management practice in general and helps prevent commoditisation.

In addition, precision in targeting means improved performance for advertisers, which in turn results in higher bidding. Monitoring which specific inventory generates the fiercest auction battles will enable them to optimise their CPMs and grow their revenue. The information from the exchange can also help a publisher's direct sales team by identifying new leads.

To sum up, instead of swimming upstream, the online advertising industry in the Nordics has great potential to raise the [display] bar for the benefit of all players in the market. They can celebrate their performance uplift over a fresh piece of grilled salmon.

Ad ServerAdvertiserAgencyDigital MarketingDisplayDSPNordicsProgrammaticPublisherSearchSSP

Follow ExchangeWire