ExchangeWire European Weekly Roundup

by on 27th Mar 2015 in News

ExchangeWire rounds up some of the biggest stories in the European ad tech landscape over the last seven days. In this week's edition: Facebook extends LiveRail to mobile apps; AOP strikes publisher alliance powered by AppNexus; Digital strikes parity with offline spend in the UK; Programmatic accounts for 45% of display; StickyADS appoints EMEA chief.

Facebook extends LiveRail to include in-app mobile display

Facebook has opened another front with Google with the extension of its LiveRail video supply-side platform (SSP) to support in-app mobile display ad formats, including native ad units, that will let publishers use the social network to connect with advertisers.

The announcement was made at this week's F8 developer conference, and will bring the social network's ad stack into more direct competition with Google's DoubleClick when it comes to advertisers' spend.

A post on the LiveRail sites reveals how controls on its dashboard allow publishers to prioritise certain buyers – including the ability to block certain advertiser categories, for brand safety, etc. – plus run real-time reports, and also get suggestions for optimal inventory pricing

The social network claims it will allow publishers to manage and optimise yield across all of their mobile advertising opportunities, including ads sold directly to advertisers and from programmatic sources like demand-side platforms (DSPs), ad networks, and agency trading desks.

Facebook claims the latest move will extend Facebook's "people-based approach" to marketing, allowing publishers to tap into its anonymised demographic targeting capabilities.

The blog post goes on to state: "We're also announcing that LiveRail will be able to tap into Facebook's anonymised people-based demographic information (age and gender at this time) to help publishers more accurately target their impressions, serve more relevant ads and reduce the waste created by inaccurate delivery."

AppNexus partners with AOP for premium alliance

The Association of Online Publishers (AOP) has lifted the lid on its publisher cooperative powered by AppNexus, with several tier-one publishers including Telegraph Media Group, Time Inc, and Bauer Media among the names to sign up to the venture at its inception.

The AOP’s publisher alliance includes audience targeting data, and inventory from: Telegraph Media Group, Time Inc., Haymarket Media Group, Dennis Publishing, Auto Trader, Future, Sift Media, and Bauer Consumer Media.

Under the direction of the AOP’s Ad Ops group, the members elected to use AppNexus technology to power its private marketplace (PMP) where members can sell “premium inventory at scale” using programmatic technology.

The AOP will appoint a manager and operations team to lead the alliance, who will also work with its publishers and AppNexus to oversee its formation, with the door remaining open for further publishers to join.

The news comes just a week after the launch of a similar publisher collective called Pangaea, where UK-based publishers the Guardian, the Economist, the Financial Times, and Reuters partnered with CNN International to form a global alliance.

Both developments point to the fact that premium publishers see strength in numbers to combat internet players such as Facebook and Google.

Half of all UK media spend goes digital

Half of all UK media spend goes digital

Research from eMarketer released this week indicates that half of all UK media spend will be invested in digital this year – a world-first that demonstrates the maturity of the medium.

Total media spend in the UK is estimated to grow by 6% in 2015 to top £16.26bn, with this being split equally between digital and all other traditional formats combined (TV, print, outdoor and radio), according to the research firm.

This is a world-first, according to eMarketer. Norway and China will follow close behind, with digital grabbing a 45% and 43.6% share, respectively, of ad spending in each country.

However, the UK will retain its lead by this measure until 2018, when digital's portion of total ad spend in China will become the largest worldwide.

Bill Fisher, eMarketer, analyst, said: "The UK ad market is notable for its aggressive embrace of online advertising and its rapid adoption of mobile advertising. Because so much TV and radio programming appears ad-free in the UK, the comparative spending on digital channels has always been high. This year, though, we're set to see digital reach an inflection point."

StickyADS appoints EMEA chief

Video SSP StickyADS.tv has appointed Massimo de Magistris as general manager for EMEA, as it's poised for further expansion in the region.

StickyADS, which provides publishers with video tech to build into their own exchanges, now boasts a 60-strong team across five offices in the region, with its aggregated video inventory, has accelerated from 200 million to four billion impressions per month, according to the company.

Massimo de Magistris initially joined StickyADS.tv in 2013 as country manager for Italy, but will be based in London and will be responsible for executing StickyADS.tv’s programmatic PMP (or private exchange) business model across Europe, and will work closely with the company’s country managers in the UK, Italy, Spain, France, and Germany.

He will also play a key role in the continued development of StickyADS.tv’s growth plan, accelerating supply-side relations by partnering with new publishers, and building new relationships with ad buyers.

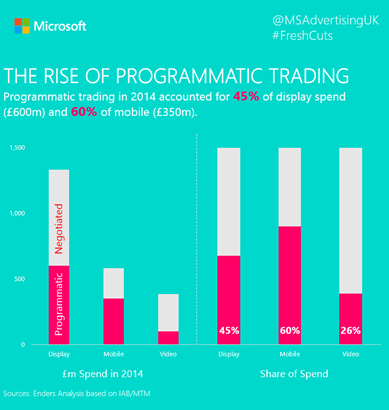

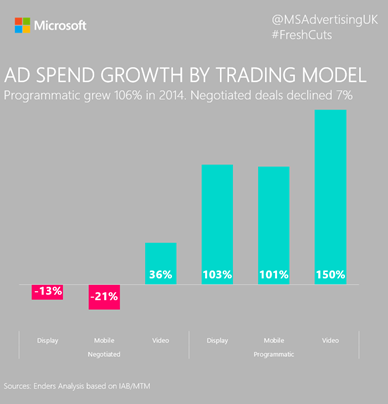

Programmatic accounts for 45% of UK display ad spend

The UK this week played host to Ad Week Europe, where Microsoft used the opportunity to reveal that programmatic trading accounted for 45% of all display ad spend last year, with the figure representing 106% growth from the previous year.

The figures also revealed that mobile's share of the display ad spend market was 60%, with video commanding a 26% share of the market (see charts).

Ad NetworkAdvertiserAnalyticsCross-ChannelDataDigital MarketingDisplayDSPEMEAExchangeExchangeWire ResearchFacebookMedia SpendMobileNativeProgrammaticPublisherRegulationSocial MediaSSPTargetingTechnologyTradingVideo

Follow ExchangeWire