ExchangeWire to Review 2014 at this Week’s TraderTalk TV Live!

by on 2nd Dec 2014 in News

ExchangeWire this week will round-off a monumental year in ad tech, with a special recording of its TraderTalk TV series in front of a LIVE STUDIO AUDIENCE, with panel sessions featuring representatives of the industry's leading names reflecting on the biggest issues of 2014, and attempting to presage what's to come in 2015.

The special one-off recording will take place tomorrow (3 December) from mid-afternoon, with available places filling up fast. A few places are still available, and those interested in attending can request an invite by sending an email to: info@exchangewire.com.

Those lucky enough to attend will be privy to insights from top-tier representatives from companies including: AppNexus, Oracle, Carat, Infectious Media, AdBrain, Vivaki and Xaxis*. Those in attendance can participate in agenda-setting debate with panelists, and use the platform to share their take on the current state of ad tech, as well as how it will develop in the near future.

So, what will be debated?

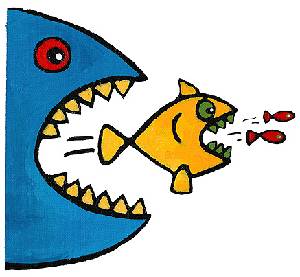

Consolidation, consolidation, consolidation...

Consolidation, consolidation, consolidation...

It’s been a dizzying year in terms of M&A deals and consolidation in the sector – the number of deals in the first half of 2014 alone numbered 209, according Results International, which additionally forecast the total to eventually double the amount of similar transactions in 2013 – with over 10 of these deals worth between $100m–$400m.

ExchangeWire recently published a post attempting to piece together some of the more recent acquisitions (including the convergence of UK pairing Ve and GDM Digital and Rubicon Project’s major move to consolidate into the programmatic direct sector).

However, a look at the bulk of the bigger purchases in the early part of the year indicates that video companies topped the shopping lists of some of the largest names in the industry with Facebook snapping up video SSP LiveRail in a deal reputed to be worth $400-$500m; this followed a deal by RTL to acquire 65% of SpotXchange for $144m, Yahoo too followed this up with a $644m purchase of BrightRoll later in the year.

Among the other European success stories (which also indicated a wider trend in the market) was the sale of social data firm Sociomantic to Tesco-owned Dunnhumby for a reputed $200m, a move which affirmed earlier ExchangeWire predictions that European ad tech firms would prove an attractive purchase for US tech giants eager to sidestep punitive domestic tax regimes by making astute foreign investments.

What of the US tech giants?

This trend is set to continue exponentially, it is worth pondering how it will continue into 2015? With Facebook already declaring that 2015 will be a massive year of investment in ad tech for the social network as it bids to follow up on its release of a revamped Atlas, a move it claims is not a threat to the wider ad tech industry, although not all are in agreement (particularly a number of the panelists that will be in attendance).

This trend is set to continue exponentially, it is worth pondering how it will continue into 2015? With Facebook already declaring that 2015 will be a massive year of investment in ad tech for the social network as it bids to follow up on its release of a revamped Atlas, a move it claims is not a threat to the wider ad tech industry, although not all are in agreement (particularly a number of the panelists that will be in attendance).

Some have suggested that Facebook’s Atlas launch puts them squarely toe-to-toe with Google in the ad tech game (which itself faces major confrontation in 2015 from no-less than the EU Government, which threatens to break up the very essence of its business), and some are even suggesting that it also places the social network ahead of Google, especially as we enter the cross-screen era. If this is the case, don’t expect the cash-rich Google to take this lying down.

Elsewhere in the ‘ad tech power game’ (a term coined by AppNexus president Michael Rubenstein and unveiled at ATS New York), let’s not forget Yahoo, a company which itself was rumoured to have spent anywhere between $700m - $1bn on ad tech firms alone this year (including its purchase of mobile analytics firm Flurry) , which is now minted with a $9.4bn windfall post the listing of Chinese ecommerce behemoth Alibaba. Just what will its investment priorities be?

Earlier in the year ExchangeWire CEO proffered his advice to Yahoo CEO Marissa Mayer, including making a major play for the local ad market with a potential purchase of Yelp, plus a further partnership with AppNexus.

This clearly has some serious areas of debate with key questions being: Are some in the ad tech space going to run out of cash? If so, will this help trigger an even bigger round of consolidation compared to 2014? Also, what will the outcome of the generic shift towards more closed ecosystems be?

Whither the agency holding group?

Agencies have been at the centre of debate this year when it comes to ad tech, especially how the emergence of ad tech will force them to reconsider their role in the value chain, especially with the growing awareness among brand-side marketers over transparency issues.

Agencies have been at the centre of debate this year when it comes to ad tech, especially how the emergence of ad tech will force them to reconsider their role in the value chain, especially with the growing awareness among brand-side marketers over transparency issues.

A move that prompted some ExchangeWire readers to ask: ‘What would happen if advertisers were to demand an alternative to the agency commission model?’

WPP

GroupM’s Xaxis this year has been busy with the completion of its 24/7 Media merger, as well as the roll out of its Xaxis Sync product. Also, let’s not forget how it has been eager to shake the ‘agency trading desk’ (ATD) tag as it rolls out its data management platform (DMP) Turbine.

However, it is at the wider holding group level, that WPP’s attitude to where ad tech sits inside its future is better explained. One of the highlights of the ad tech year was the landmark $25m deal that saw WPP take a 15% stake in AppNexus, building on the ad tech firm’s earlier $85m funding round (valuing it at $1.2bn).

This transaction lead Sir Martin Sorrell, WPP, CEO, to note that rival holding groups Omnicom and Publicis Groupe now had: “Nowhere to go”, given that it was the only agnostic ad tech platform in the industry, especially when it is considered in the same light as Facebook and Google’s ecosystems (more on this below).

It is also worth nothing that one of the more popular ExchangeWire posts this year pondered on potential pivots for WPP’s GroupM, and whether or not its Xaxis unit will become WPP’s supply-side exchange?

This is not to say other groups have been standing idly by. Publicis Groupe itself made a series of acquisitions and alliances in the ad tech sector, notably its acquisition of mobile DMP RUN, and $40m stake in Israeli ad network Matomy.

This builds on earlier deals with Adobe and AOL to improve its attribution and video buying capabilities.

However, this in addition to its mammoth acquisition of digital specialist agency Sapient Group did lead investment advisors to ask the question of whether or not this activity will add value to the France-based holding group’s bottom line?

The enduring value of the service layer

Of course, the big question over the role of the agency in the programmatic era is whether or not brands will cut their ties with media agencies in favour of building their own trading desks, therefore saving themselves millions in agency commission fees?

As mentioned above, this question has been asked many times in the last 12 months, and long beforehand, but increasingly in 2014, the response from ExchangeWire sources has been a resounding: “No!”

In a widely-sourced piece in the run-up to ATS London, sources from across various tiers of the industry pointed out that it is simply unfeasible for the ‘client-direct’ model to predominate, rather it will require agencies to retool in terms of skill sets.

Arguably, the most prominent voice to come out in support for agencies in the programmatic era was Brian O’Kelley, AppNexus, CEO, who has repeatedly stated his belief that agencies are the best home for ad tech, especially as Google and its Silicon Valley peers attempt to "own ad tech", a scenario he was oft to advise against in 2014. A point-of-view that is sometimes echoed by AppNexus’ nearest rival in the ad tech space IPONWEB.

But with brand marketing agencies increasingly advising their members to get wise to programmatic, this is far from ‘fait accomplit’.

Was 2014 actually the ‘Year of the Bot?’

Was 2014 actually the ‘Year of the Bot?’

Of course, with all the heady success of the ad tech sector, it brought with it scrutiny, bringing much woe to some of the industry’s leading names, as fraudulent traffic became an issue that hit the pages of some of the media’s biggest mainstream titles.

Some of the most popular posts on this publication in the last 12 months have also attempted to grasp this thorny issue, and it was arguably RocketFuel (which became in a high-profile row with the FT, after an article implicating it with fraudulent traffic on a Mercedes-Benz campaign) that was the biggest victim of this exposure.

AppNexus too, was involved too in a similar controversy, and has vowed to spearhead an industry-wide alliance promising not to charge advertisers for “invalid traffic” as we enter 2015, but we can be sure that this is not the last we’ve heard of this issue.

All this and more

The above issues are but a few of the areas to be debated, the highlights of which will soon be aired on this publication. Those eager to help shape the agenda-setting discussions should get in touch on the details listed above, or express an interest in ExchangeWire’s 2015 ATS series.

*Panelists will include:

Host/moderator: Ciaran O’Kane, ExchangeWire, CEO

Nigel Gilbert, AppNexus, VP sales, EMEA

Zuzanna Gierlinska, Oracle Marketing Cloud, director, strategic agencies & account, EMEA,

Gareth Davies, AdBrain, CEO

Danny Hopwood, Vivaki, head of platform, EMEA

Caspar Schlikum, Xaxis, CEO, Europe

Anthony Rhind, Carat, global chief digital officer

Martin Kelly, Infectious Media, CEO

Ad FraudAdvertiserAgencyAnalyticsattributionCross-ChannelDataFacebookGoogleMedia SpendMobileProgrammaticRegulationTargetingTechnologyTradingTrading DeskTransparency

Follow ExchangeWire